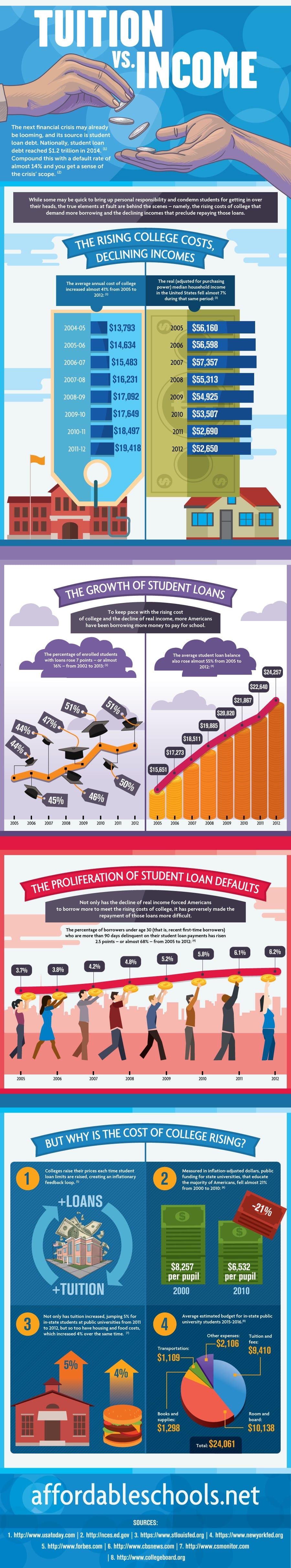

Tuition vs. Income

The next financial crisis may already be looming, and its source is student loan debt. Nationally, student loan debt reached $1.2 trillion in 2014. (1) Compound this with a default rate of almost 14% and you get a sense of the crisis’ scope. (2)

While some may be quick to bring up personal responsibility and condemn students for getting in over their heads, the true elements at fault are behind the scenes – namely, the rising costs of college that demand more borrowing and the declining incomes that preclude repaying those loans.

The Rising College Costs, Declining Incomes

The average annual cost of college increased almost 41% from 2005 to 2012: (2)

2004-05: $13,793

2005-06: $14,634

2006-07: $15,483

2007-08: $16,231

2008-09: $17,092

2009-10: $17,649

2010-11: $18,497

2011-12: $19,418

The real (adjusted for purchasing power) median household income in the United States fell almost 7% during that same period: (3)

2005: $56,160

2006: $56,598

2007: $57,357

2008: $55,313

2009: $54,925

2010: $53,507

2011: $52,690

2012: $52,650

The Growth of Student Loans

To keep pace with the rising cost of college and the decline of real income, more Americans have been borrowing more money to pay for school.

The percentage of enrolled students with loans rose 7 points – or almost 16% – from 2002 to 2013: (2)

2005: 44%

2006: 45%

2007: 44%

2008: 46%

2009: 47%

2010: 51%

2011: 50%

2012: 51%

The average student loan balance also rose almost 55% from 2005 to 2012: (4)

2005: $15,651

2006: $17,273

2007: $18,511

2008: $19,885

2009: $20,820

2010: $21,867

2011: $22,640

2012: $24,257

The Proliferation of Student Loan Defaults

Not only has the decline of real income forced Americans to borrow more to meet the rising costs of college, it has perversely made the repayment of those loans more difficult.

The percentage of borrowers under age 30 (that is, recent first-time borrowers) who are more than 90 days delinquent on their student loan payments has risen 2.5 points – or almost 68% – from 2005 to 2012: (4)

2005: 3.7%

2006: 3.8%

2007: 4.2%

2008: 4.8%

2009: 5.2%

2010: 5.8%

2011: 6.1%

2012: 6.2%

But Why is the Cost of College Rising?

1. Colleges raise their prices each time student loan limits are raised, creating an inflationary feedback loop. (5)

2. Measured in inflation-adjusted dollars, public funding for state universities, that educate the majority of Americans, fell 21% from 2000 to 2010: (6)

2000: $8,257 per pupil

2010: $6,532 per pupil

3. Not only has tuition increased, jumping 5% for in-state students at public universities from 2011 to 2012, but so too have housing and food costs, which increased 4% over the same time. (7)

Average estimated budget for in-state public university students 2015-16: (8)

Tuition and fees: $9,410

Room and board: $10,138

Books and supplies: $1,298

Transportation: $1,109

Other expenses: $2,106

Total: $24,061

Sources:

1. http://www.usatoday.com

2. http://nces.ed.gov

3. https://www.stlouisfed.org

4. https://www.newyorkfed.org

5. http://www.forbes.com

6. http://www.cbsnews.com

7. http://www.csmonitor.com

8. http://www.collegeboard.org

The Best Colleges

The Best Colleges The Lowest Costs

The Lowest Costs The Highest Returns

The Highest Returns