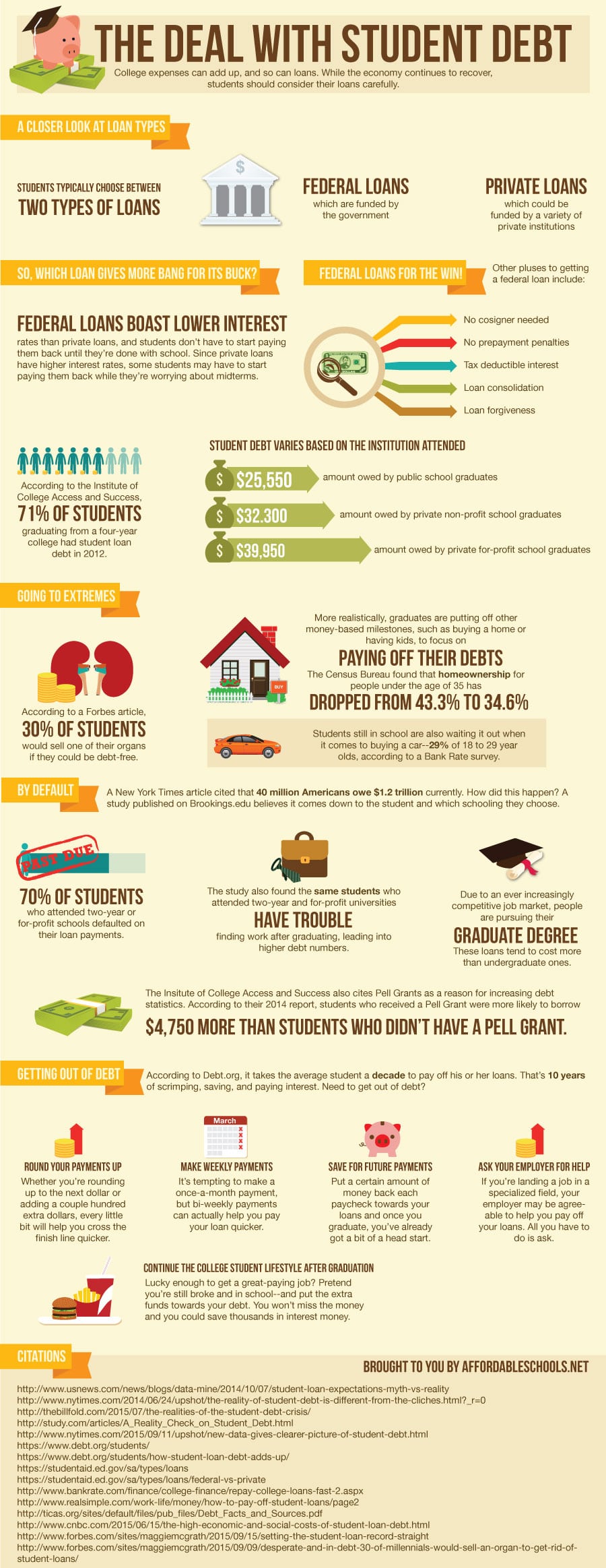

The Deal With Student Debt

College expenses can add up, and so can loans. While the economy continues to recover, students should consider their loans carefully.

A Closer Look at Loan Types

Students typically choose between two types of loans:

• Federal loans, which are funded by the government.

• Private loans, which could be funded by a variety of private institutions. Banks and credit unions are examples of this type of lender, but universities may also offer loans to students.

So, Which Loan Gives More Bang For Its Buck?

Federal loans boast lower interest rates than private loans, and students don’t have to start paying them back until they’re done with school. Since private loans have higher interest rates, some students may have to start paying them back while they’re worrying about midterms.

Federal Loans For The Win!

Other pluses to getting a federal loan include:

• No cosigner needed

• No prepayment penalties

• Tax deductible interest

• Loan consolidation

• Loan forgiveness (if you end up working in the public sector)

A Growing Issue

Loan debt has continued to grow over the last decade, and students are carrying heavy burdens across that stage when they get their degree.

• According to the Institute of College Access and Success, 71 percent of students graduating from a four-year college had student loan debt in 2012.

Student debt varies based on the institution attended.

• $25,550: amount owed by public school graduates

• $32,300: amount owed by private non-profit school graduates

• $39,950: amount owed by private for-profit school graduates

Going to Extremes

• According to a Forbes article, 30 percent of students would sell one of their organs if they could be debt-free.

• More realistically, graduates are putting off other money-based milestones, such as buying a home or having kids, to focus on paying off their debts. The Census Bureau found that homeownership for people under the age of 35 has dropped from 43.3 percent to 34.6 percent. Students still in school are also waiting it out when it comes to buying a car–29 percent of 18 to 29 year olds, according to a Bank Rate survey.

By Default

A New York Times article cited that 40 million Americans owe $1.2 trillion currently. How did this happen? A study published on Brookings.edu believes it comes down to the student and which schooling they choose.

• Approximately 70 percent of students who attended two-year or for-profit schools defaulted on their loan payments.

• The study also found the same students who attended two-year and for-profit universities have trouble finding work after graduating, leading into higher debt numbers.

• Due to an ever increasingly competitive job market, people are pursuing their graduate degree. These loans tend to cost more than undergraduate ones.

The Institute of College Access and Success also cites Pell Grants as a reason for increasing debt statistics. According to their 2014 report, students who received a Pell Grant were more likely to borrow $4,750 more than students who didn’t have a Pell Grant.

Getting Out of Debt

According to Debt.org, it takes the average student a decade to pay off his or her loans. That’s 10 years of scrimping, saving, and paying interest. Need to get out of debt?

• Round your payments up. Whether you’re rounding up to the next dollar or adding a couple hundred extra dollars, every little bit will help you cross the finish line quicker.

• Make weekly payments. It’s tempting to make a once-a-month payment, but bi-weekly payments can actually help you pay your loan quicker.

• Save now for future payments. Every college student should have a savings account for emergencies. Put a certain amount of money back each paycheck towards your loans and once you graduate, you’ve already got a bit of a head start.

• Ask your employer for help. (No, really!) If you’re landing a job in a specialized field, such as nursing or technology, your employer may be agreeable to help you pay off your loans as part of your contract. All you have to do is ask.

• Continue the college student lifestyle after graduation. Lucky enough to get a great-paying job? Pretend you’re still broke and in school–and put the extra funds towards your debt. You won’t miss the money and you could save thousands in interest money.

http://www.usnews.com/news/blogs/data-mine/2014/10/07/student-loan-expectations-myth-vs-reality

http://www.nytimes.com/2014/06/24/upshot/the-reality-of-student-debt-is-different-from-the-cliches.html?_r=0

http://thebillfold.com/2015/07/the-realities-of-the-student-debt-crisis/

http://study.com/articles/A_Reality_Check_on_Student_Debt.html

http://www.nytimes.com/2015/09/11/upshot/new-data-gives-clearer-picture-of-student-debt.html

https://www.debt.org/students/

https://www.debt.org/students/how-student-loan-debt-adds-up/

https://studentaid.ed.gov/sa/types/loans

https://studentaid.ed.gov/sa/types/loans/federal-vs-private

http://www.bankrate.com/finance/college-finance/repay-college-loans-fast-2.aspx

http://www.realsimple.com/work-life/money/how-to-pay-off-student-loans/page2

http://ticas.org/sites/default/files/pub_files/Debt_Facts_and_Sources.pdf

http://www.cnbc.com/2015/06/15/the-high-economic-and-social-costs-of-student-loan-debt.html

http://www.forbes.com/sites/maggiemcgrath/2015/09/15/setting-the-student-loan-record-straight

http://www.forbes.com/sites/maggiemcgrath/2015/09/09/desperate-and-in-debt-30-of-millennials-would-sell-an-organ-to-get-rid-of-student-loans/

The Best Colleges

The Best Colleges The Lowest Costs

The Lowest Costs The Highest Returns

The Highest Returns