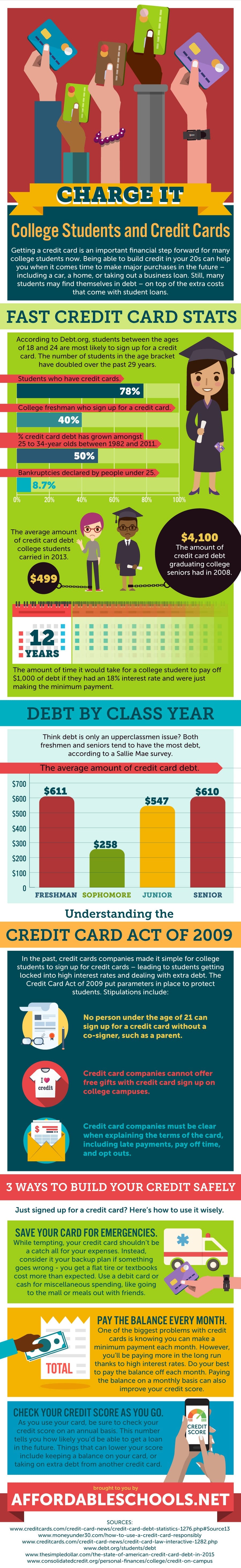

Charge It: College Students and Credit Cards

Getting credit cards is an important financial step forward for many college students now. Being able to build credit in your 20s can help you when it comes time to make major purchases in the future – including a car, a home, or taking out a business loan. Still, many students may find themselves in debt – on top of the extra costs that come with student loans.

Fast Credit Card Stats

According to Debt.org, students between the ages of 18 and 24 are most likely to sign up for a credit card. The number of students in the age bracket have doubled over the past 29 years.

• 78 percent: The percentage of students who have credit cards.

• 40 percent: The percentage of college freshman who sign up for a credit card.

• 50 percent: The percentage that credit card debt has grown amongst 25- to 34-year olds between the years of 1982 and 2011, according to Debt.org.

• $4,100:The amount of credit card debt graduating college seniors had in 2008, according to Debt.org.

• $499: The average amount of credit card debt college students carried in 2013, according to a Sallie Mae survey.

• 8.7 percent: The percentage of bancruptcies declared by people under the age of 25.

• 12 years: The amount of time it would take for a college student to pay off $1,000 of debt if they had an 18 percent interest rate and were just making the minimum payment.

Debt By Class Year

Think debt is only an upperclassmen issue? Both freshmen and seniors tend to have the most debt, according to a Sallie Mae survey.

• $611: The average amount of freshman credit card debt.

• $258: The average amount of sophomore credit card debt.

• $547: The average amount of junior credit card debt.

• $610: The average amount of senior credit card debt.

Understanding the Credit Card Act of 2009

In the past, credit cards companies made it simple for college students to sign up for credit cards – leading to students getting locked into high interest rates and dealing with extra debt. The Credit Card Act of 2009 put parameters in place to protect students. Stipulations include:

• No person under the age of 21 can sign up for a credit card without a co-signer, such as a parent.

• Credit card companies cannot offer free gifts with credit card sign up on college campuses.

• Credit card companies must be clear when explaining the terms of the card, including late payments, pay off time, and opt outs.

3 Ways to Build Your Credit Safely

Just signed up for a credit card? Here’s how to use it wisely.

• Save your card for emergencies. While tempting, your credit card shouldn’t be a catch all for your expenses. Instead, consider it your backup plan if something goes wrong – you get a flat tire or textbooks cost more than expected. Use a debit card or cash for miscellaneous spending, like going to the mall or meals out with friends.

• Pay the balance every month. One of the biggest problems with credit cards is knowing you can make a minimum payment each month. However, you’ll be paying more in the long run thanks to high interest rates. Do your best to pay the balance off each month. Paying the balance on a monthly basis can also improve your credit score.

• Check your credit score as you go. As you use your card, be sure to check your credit score on an annual basis. This number tells you how likely you’d be able to get a loan in the future. Things that can lower your score include keeping a balance on your card, or taking on extra debt from another credit card.

Sources:

http://www.creditcards.com/credit-card-news/credit-card-debt-statistics-1276.php#Source13

http://www.moneyunder30.com/how-to-use-a-credit-card-responsibly

http://www.creditcards.com/credit-card-news/credit-card-law-interactive-1282.php

https://www.debt.org/students/debt/

http://www.thesimpledollar.com/the-state-of-american-credit-card-debt-in-2015/

The Best Colleges

The Best Colleges The Lowest Costs

The Lowest Costs The Highest Returns

The Highest Returns